| |

|

Financial Management

Table of Contents

|

|

|

Financial Management lays the foundation for IT services to be customer-led, accountable, cost conscious and forward looking. Effective Cost control is absolutely critical to the solvency of the whole organization, IT Services cannot maximize value for money if they do not know the costs involved. The primary objectives of Cost Management should be to recover from the user the costs for the service provided, including capital costs. This should be achieved by making the Users aware of costs that are incurred on the system when they use it.

Process Requires Re-writing for conformance with ITIL Version 3.

More...

|

|

|

Introduction to Financial Management

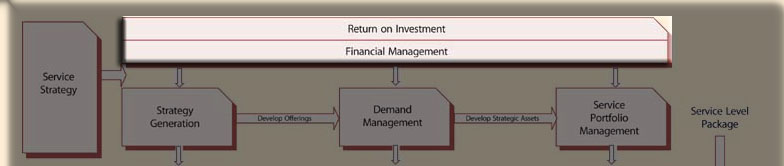

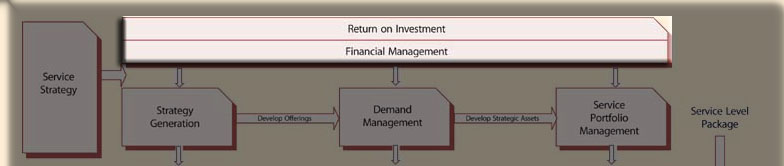

Financial Management is a process within the Service Strategy module of the ITIL Service Lilfecycle.

Financial management utilizes accounting principles found in use today across a wide variety of industries specifically for IT - (eg. budgeting, cost accounting, cost recovery, cost allocations, charge-back models, and revenue accounting). These key aspects of financial management describe much of its' functionality and purpose within an IT Service Management methodology. This rationale is equally applicable in the consideration of human resources, facilities, purchasing and a host of other suoport functions which an IT Provider, as a business entity, must provide to support ongoing operations. Note that COBIT cites these other functions as core governance requirements.

FM provides the expense, or cost, side of the equation for making a business decision with regard to changes in the IT infrastructure, systems, staffing, or processes. Knowing the costs of configuration and change request items is key to making intelligent business decisions. FM also addresses the revenue, or benefits, side of the financial equation. Historically, IT has been largely viewed as merely a cost center; in recent times, however, IT has assumed greater importance as a revenue and profit center.

![[To top of Page]](../images/up.gif)

Financial Management

The goal is …

| 'to provide cost-effective stewardship of the IT assets and resources used in providing IT Services in order to contribute to meeting business profit and marketing goals and objectives'.

|

This is accomplished by:

- 'accounting fully for the spending on IT Services and to attributing these costs to the services delivered to the organization's Customers'

- 'assisting management in making decisions on IT investment by providing detailed business cases for Changes to IT Services'

Critical Success Factors

- End-users, business process owners and the IT organization share a common understanding of costing requirements and cost allocation

- Direct and indirect costs are identified, captured, reported and analyzed in a timely and automated manner

- Costs are charged back on the basis of utilization and recorded in charge-back principles that are formally accepted and regularly re-assessed

- Cost reporting is used by all parties to review budget performance, to identify cost optimization opportunities and to benchmark performance against reliable sources

- There is a direct link between the cost of the service and the service level agreements

- The results of cost allocation and optimization are used to verify benefit realization and are fed back into the next budget cycle

![[To top of Page]](../images/up.gif)

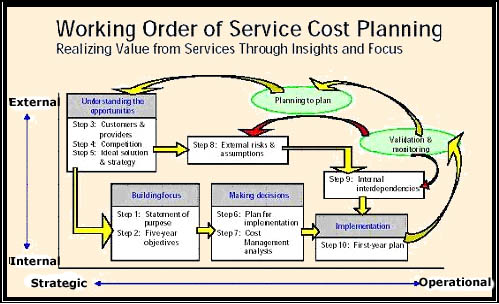

The major emphasis of Financial Management (FM) is to understand, track, and minimize the cost of IT service while achieving the highest possible levels of service delivery. FM consists of Annual Planning and Monthly Variance Analysis.

Scope

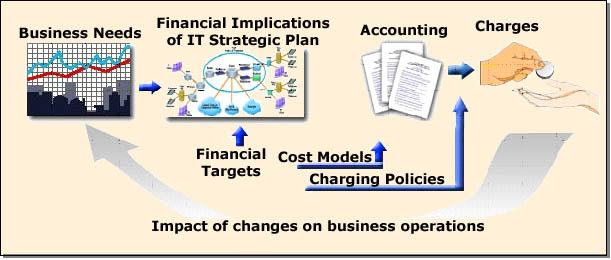

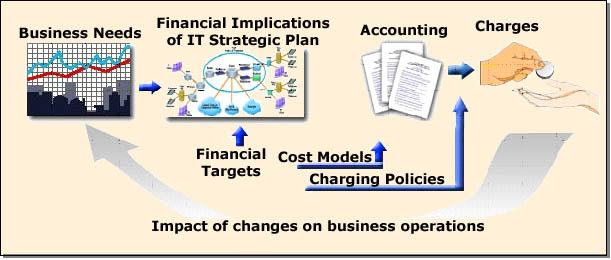

FM is the balance between costing (deriving cost units based on the IT components which make up Service deliveries) and charging (defining service policies with customers for the fair recovery of cost of services based on usage). It is very important to understand the distinctions between costing and charging and their different activities based on the annual versus the monthly cycle:

|

|

Costing

| Charging

|

| Annual Planning

| Establish standard unit costs for each major IT service (drill down to each IT resource)

| Establish a pricing portfolio and a Price List for each item to be used in calculation of charges

|

| Monthly Variance Reporting

| Monitor expenditures and compare plans to actuals by unit cost

| Track service (resource) usage, calculate charges, and issue invoices

|

In Scope

IT Financial management covers the following types of activities:

- Identification of assets and activities to which costs are assigned

- Development of cost allocation schemes to enable the cost elements to be fairly distributed to customers for services they have received

- Budget development, based on planned future activities

- The assesssment of budgetary performance - financial management gathers information from each organizational department that uses IT services and each service within the organization.

- Analysis of costs and benefits of proposed changes and new services - Financial Management uses several methods of analyzing the financial impact of a proposed request for change, including pay-back period, net present value, return on investment, total cost of ownership, and real cost of ownership.

- The Recovery of IT service costs from the customers by developing charge-back methods and the billing of costs to customers

Usually Excluded

Charging for any business services with are non IT related.

Assumptions

All departments and services within the organization participate in the Financial Management process.

Relationship to Other Processes

Financial Management for IT Services interacts with most IT Service processes and has particular dependencies upon and responsibilities to:

| “Without reasonably functioning Configuration and Capacity Management processes, you might as well use darts or dice to determine an IT budget. Configuration Management deals with the pieces that make up your IT landscape (e.g. applications, network, servers) and how they interact, Capacity Management deals with planning your space. The reports coming from these two areas are crucial in ascertaining what you have (your present IT assets) and your future direction (your investment and operating budget). ”

Jan Vromant, ITSM Watch, January 28, 2004, Getting IT What it Needs from the IT Financial Management Process |

Service Level Management

The SLA specifies Customer expectations and IT Services obligations. The cost of meeting the Customer's requirements may have major impact on the shape and scope of the services that are eventually agreed. IT Finance Management liaises with Service Level Management about the costs of meeting current and new business demands, the Charging policies for the organization, their effects on Customers and how the policies are likely to influence Customer and User behaviour. The more that the SLA allows individual Customers to request variations to service levels, the greater is the scope for (and potential benefits of) Charging for IT Services but also the greater the overheads of Budgeting, IT Accounting and Charging.

Capacity Management

The Systems Performance & Capacity Management Unit reviews and processes mid and long-term needs. Their review may generate the need for additional financial data that may not be gathered from the organizaiton's hardware forecast. If necessary, a member of the Systems Performance & Capacity Management Unit may contact the appropriate Hardware Forecast Coordinators to gather this information.

Configuration Management

Financial Management requires asset and cost information that may be managed by large organization-wide systems. Configuration-Management is responsible for managing the data relating to assets (Configuration Items) and their attributes (e.g. cost).

![[To top of Page]](../images/up.gif)

- Financial Management should provide a budget estimate, monthly forecast and monthly actual costs for each Service described in the Service Catalog.

- Financial Management should assure the clear and correct communication of all charging and pricing policies to the Service communities to which they pertain.

- Payment for IT Services should be budgeted and provided at the time of that Service's price based on availability, workload and capacity plans as determined in conjunction with the customer. Release of payment from the Service budget will be based on actual monthly usage.

- the organization should recover all of its' operating costs.

- Wherever practical (costs of collecting data outweigh gains in the fairness of distribution) costs will be distributed by usage based upon the most accurate historical method .

- Desktop costs will be assess and charged on a Per Seat basis. Included in the per seat cost will be:

- Cost of leasing a personal computer - laptop or workstation with variations permitted in model adding to allocated cost

- Cost of software constituting the basic image.

- Cost of installation of computing resource

- Access to LAN, shared network(s), printers, file storage, remote access services

- Internet and intranet access

- Support through telephone and Online access

![[To top of Page]](../images/up.gif)

![[To top of Page]](../images/up.gif)

Financial Management is the sound stewardship of the monetary resources of the organization. IT supports the organization in planning and executing its business objectives and requires consistent application throughout the organization to achieve maximum efficiency and minimum conflict. As displayed in the illustration to the right, Financial Management acts as a filter between SLM and the other disciplines involved in Service Delivery.

Within an IT organization it is visible in three main processes:

- Budgeting is the process of predicting and controlling the spending of money within the organization and consists of a periodic negotiation cycle to set budgets (usually annual) and the day-to-day monitoring of the current budgets

- IT Accounting is the set of processes that enable the IT organization to account fully for the way its money is spent (particularly the ability to identify costs by Customer, by service, by activity). It usually involves ledgers and should be overseen by someone trained in accountancy

- Charging is the set of processes required to bill Customers for the services supplied to them. To achieve this requires sound IT Accounting, to a level of detail determined by the requirements of the analysis, billing and reporting processes.

The aim of Budgeting is that the actual costs match the budget (predicted costs). This budget is usually set by negotiations with the Customers who are providing the funds (although this sometimes happens at a very gross level i.e. the business leaders agree proportions of their revenue which is to be used to fund IT, based upon what IT have told them their costs are). Good Budgeting is essential to ensure that the money does not run out before the period end. Where shortfalls are likely to occur the organization needs early warning and accurate information to enable good decisions to best manage the situation.

Organizations which need to account and charge to a very high level of accuracy, e.g. commercial IT Service providers, need to invest much more effort in developing IT Accounting and Charging systems than those who seek only a fair, simple apportionment of costs back to business units. IT Accounting can be used to determine the exact costs of resource usage down to CPU, filestore and bandwidth but it is rarely advisable to use this as the basis for charging as the costs of so doing may outweigh the benefits. It is in the interest of all parties to keep the overall cost of service low and the bureaucracy to a minimum, even at the expense of total precision.

Current leading practice is to use IT Accounting to aid investment and renewal decisions and to identify inefficiencies or poor value but to charge a fixed amount for an agreed Capacity (determined by the level of service agreed in the Service Level Agreements or SLAs). In this case, IT Finance Management works with Service Level Management (they may even be the same person) to ensure that the overall costs of running the agreed services should not exceed the predicted costs. Charging is then often a matter of billing for agreed periods at an agreed rate, for example 1/12 of each Customer's IT budget each calendar month. Additional charges are made for work above the agreed service levels (e.g. office moves, major roll-out, unplanned hardware upgrade).

Annually, each Division Forecast Coordinator provides a monthly forecast of utilization by Service. The purpose of the forecast is to obtain an estimate of utilization by service category that is then used to determine the Data Center Rate for each service and subsequently the Business Group's budgeted annual Data Center Service costs for the year.

The Forecast Cycle begins in April of each year with the verification of the Forecast Coordinator , and then a verification of the Area Application codes within their scope of responsibility. Around the middle of June, there is a formal Hardware Forecast kickoff meeting where the instructions and guidelines for the annual cycle are presented and reviewed. The actual Forecast inputting normally occurs during June & July, followed by a "Rationale Paper", due near the end of July, documenting the variance from the previous year and the business drivers that's impacting the current forecast numbers.

In summary:

-

Budgeting enables an organization to:

- predict the money required to run IT Services for a given period

- ensure that actual spending can be compared with predicted spending at any point

- reduce the risk of overspending

- ensure that revenues are available to cover predicted spending (where Charging is in place).

IT Accounting enables an organization to:

- account for the money spent in providing IT Services

- calculate the cost of providing IT Services to both internal and external Customers

- perform cost-benefit or Return-on-Investment analyses

- identify the cost of Changes.

Charging enables an organization to:

- recover the costs of the IT Services from the Customers of the service

- operate the IT organization as a business unit if required

- influence User and Customer behaviour.

![[To top of Page]](../images/up.gif)

Budgeting

A budget is a detailed plan that specifies how resources are acquired and used over a specified period. Budgeting is the activity of predicting how much money the organization will spend during a specified period. It also involves controlling the distribution of money to areas for which it was originally budgeted, thereby ensuring that sufficient funds are available throughout the entire period. Budgeting allows organizations to plan for routine operational costs as well as significant expenses, such as purchasing a new group of servers or storage devices.

When developing a budget, management assesses the department's goals and objectives based on input from a variety of sources. In order to meet the budget, a plan for attaining the goals and objectives must be developed. So, in a real sense, the budgeting process helps management focus its direction and priorities.

IT financial managers develop two separate budgets: an operational budget and a capital budget. An operational budget plans for the costs associated with operating and maintaining the IT environment over a specified period corresponding to the fiscal year. The capital budget is a longer-range budget (three to five years) that plans expenses for capital assets such as servers and networks. Executive management or the organizational budget committee must review and approve all departmental budgets.

It is the responsibility of the Financial Manager to prepare IT budgets. Inputs are required from all departments within the organization that use IT services, as well as from all service managers. The Financial Manager specifies parameters around the process that are used and the information that is required from each department and service managers. The Financial Manager provides Forecast Instructions to Divisional Hardware Forecast Coordinators. These instructions launch the budget exercise and eventually facilitate the negotiation of SLAs and the development of the IT budget. This process can take several months to complete. This gives the financial manager sufficient time to coordinate the collection of the necessary departmental and service information needed to develop the budget plan.

Some of the things that must be considered when developing a budget include:

- Prior period trends. Examine trends of service levels over past budget periods to approximate future requirements.

- Service level agreements (SLAs) with each organizational group. SLAs specify the service levels that are provided to customers as well as the costs for providing those services.

- IT organizational requirements such as personnel training and system upgrades. Significant IT environment changes may require significant resources, which must be planned for in advance.

- Organizational changes. For example, if a department is outsourced, then the IT department would no longer be required to provide these services. Or the enterprise may be in an expansion phase, requiring greater IT services.

- Industry and economic trends. Examine how trends in the industry or general economic trends will affect the need for IT services.

- Special requirements such as developing "in-house" applications. Depending on the scope of the applications being developed, significant resources may be required.

- Customer satisfaction. The financial manager can also use surveys to determine how the services from the prior budget period were performed. Customer satisfaction surveys help to determine if the correct level of service is being provided, especially in regards to the operation of the service desk.

![[To top of Page]](../images/up.gif)

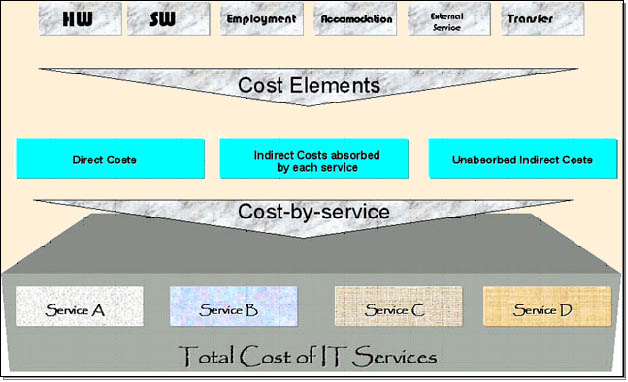

IT Accounting

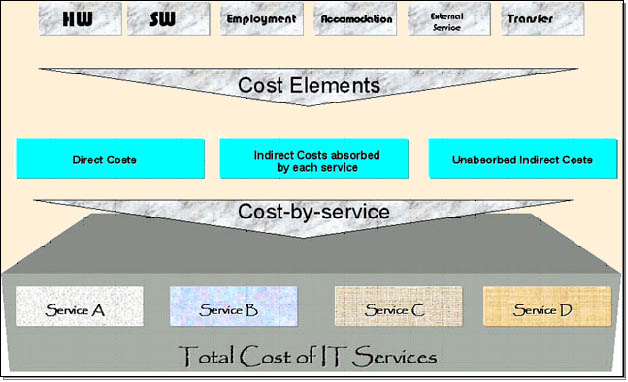

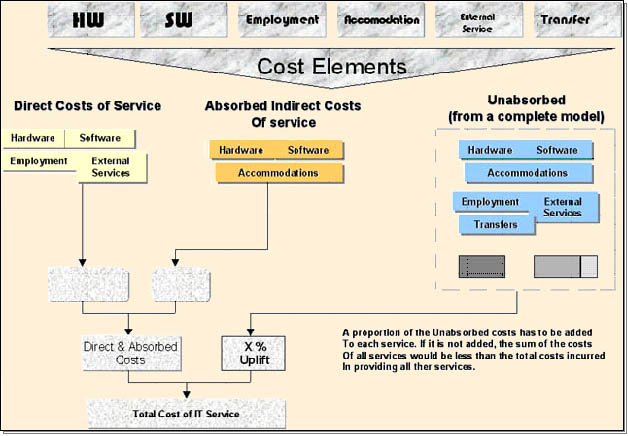

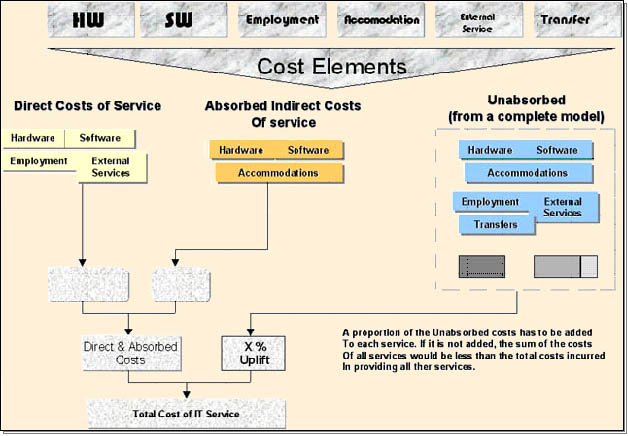

To calculate the costs of IT Service provision, it is necessary to design a framework in which all known costs can be recorded and allocated to specific Customers, activities, services or other categories This is called a Cost Model. Most Cost Models are based on calculating the cost for each Customer (but other models can be developed to show the cost for each service or the costs for each location). This description concentrates on a Cost Model that enables the calculation of Costs-by-Customer, which is the usual start-point if a Charging system is to be. For estimating the cost of budget items, it is useful to categorize costsRef to ensure that they are correctly identified and managed.

The Costs-by-Customer Cost Model requires that all major cost elements in the current or proposed IT budget are identified and then attributed to the Customers who 'cause' them.

To do this, the costs first have to be identified as either Direct or Indirect:

- Direct Costs are those clearly attributable to a single Customer, e.g. an office facility allocated to a person in a single Division

- Indirect Costs (sometimes called overheads) are those incurred on behalf of all, or a number of, Customers (e.g. the network or the technical support department), which have to be apportioned to all, or a number of, Customers in a fair manner.

Any Indirect Costs, which cannot be apportioned to a set of Customers (sometimes called Unabsorbed Overheads), have then to be recovered from all Customers in as fair a way as is possible, usually by uplifting the costs calculated so far by a set amount. This ensures that the sum of all of the costs attributed to each Customer still equals the total costs incurred by the IT organization.Ref

For costs which are mainly Direct, (eg., Customer has independent hardware and software), methods of recording and of apportioning costs are simple. However, for resources which are shared, (for instance a mainframe running applications for more than one Customer), the hardware costs have to be classified as indirect and apportioned to each Customer, (say by CPU-seconds/disk storage/print volumes/etc from workload predictions).This requires a model that allows these costs to be spread across a number of Customers.

In the example below, it is assumed that there are 3 businesses or departments, who together are responsible for all of the IT costs. The three departments are Marketing and Sales, Manufacturing and Finance and all of the IT systems and services have been implemented on their behalf.

An example of the calculation of a Cost Model for a simple Cost-by-Customer is shown in this display. The same principles can be applied to calculating the costs of individual application services or even parts of a service e.g. support and maintenance.

If the cost of providing some element of a service is desired, for instance producing large reports for the Marketing and Sales department, this may require measurement of resource usage to apportion indirect costs to this one activity e.g. computer time consumed, printing and operations staff and facilities. This can become very complex and would normally be treated as a separate exercise rather than as part of the standard Cost Model used for calculating Costs-by-Customer.

To derive cost information and report it in the formats required, it is necessary to ensure that all costs recorded are classified to a standard system with a level of detail that anticipates future Changes, e.g. New Cost centers, new equipment types, new project codes.

Capital & Operational Costs

For financial purposes, costs are classified into either Capital or Operational when the financial ledgers are reported (the 'books'). This is because Capital expenditure is assumed to increase the total value of the company, while Operational expenditure does not, although in practice the value of Capital expenditure decreases over time (depreciates).

This distinction affects IT Accounting because the Cost Model needs a method of calculating the annual cost of using a capital item (e.g. mainframe) to deliver IT Service. The annual costs must make allowance for the decreasing value- of capital items (assets) and make for timely renewal of capital items e.g. buildings, servers, applications. Usually, this is taken as the annual depreciation, from a method set by the Finance department (within the boundaries of the country's laws). Capital Costs are typically those applying to the physical (substantial) assets of the organization. Traditionally this was the accommodation and machinery necessary to produce the organization's product. Capital Costs are the purchase or major enhancement of fixed assets, for example computer equipment, building and plant are often also referred to as 'one-off 'costs. It is important to remember that it is not usually the actual cost of items purchased during the year that is included in the calculation of the cost of the services but the annualized depreciation for the year.

Operational Costs are those resulting from the day-to-day running of the IT Services organization, e.g. staff costs, hardware maintenance and electricity, and relate to repeating payments whose effects can be measured within a short timeframe, usually less than the 12-month financial year. Personal Computers have undergone a shift from being seen as Capital Assets to Operating costs. Studies such as Gartner's Total Cost of Ownership (TCO) have identified their replacement over an increasingly shorter period of time (approaching two years for laptops). This increasingly makes leasing a more attractive alternative to purchasing them with the associated tax need for depreciation schedules attached to them.

Cost By Service

To this point we have been considering the Cost Model for calculating costs attributable to a Customer - costs by department. To calculate the Costs -by-service, the Cost Model may require more detail. The basic approach is similar:

- identify all those costs that can be directly attributed to the service being analyzed, for instance any dedicated hardware, software, staff or contracts

- decide how to apportion the Indirect Costs such as Infrastructure

- adjust the total to allow for 'hidden costs' or 'Unabsorbed overheads' such as IT management or buildings - this must be the same uplift figure calculated for the whole model, or used from the Costs-by-Customer Cost Model, i.e. 89.1%.

It is best to consider the model as being one layer of a set of models, one for each service, so that, if the costs for each service provided are added together, this would again give the total of the costs incurred by the IT organization. Even if only Service A is of interest, it is important to ensure that all costs are identified and attributed to the other services, as shown here.

It is then necessary to identify those costs that can fairly be attributed directly to the provision of this service and to apportion those Indirect Costs in a manner that reflects the proportion of them that result from the provision of this service.

It is then necessary to identify those costs that can fairly be attributed directly to the provision of this service and to apportion those Indirect Costs in a manner that reflects the proportion of them that result from the provision of this service.

It may not be possible to identify costs in every category. For example there may be no Direct Accommodation costs and no Absorbed Accommodation or Staff costs - these may all be included in the Unabsorbed Costs (as illustrated), which have to be included fairly in the costs of every service.

Exercise Common Sense

When systems change, underlying costs also change. To avoid having to recalculate costs for Cost Units too frequently, IT Finance Management will anticipate Changes or defer the inclusion of the cost in the Cost Model until stable usage has been established.sRef

When performing detailed cost analysis, a cost recovery plans is needed to provide a picture of under (or over) calculation. IT Finance Management will leave the cost per Cost Unit unchanged until the error is greater than, say, 5% to avoid copious recalculations.

![[To top of Page]](../images/up.gif)

Charging Methods

The Charging systems described should enable an organization to:

- determine the most suitable Charging policies for their organization

- recover fairly and accurately, the agreed costs of providing the services

- shape Customer and User behaviour to ensure optimal return on IT investment by the organization.

Such a system controls IT Service costs and influences the proper use of IT resources, so that these scarce resources are used in the manner that best reflects business need.

Traditional, centrally funded, IT Service organizations are under pressure from many sides. They are expected to reduce overall costs while maintaining or improving service in an increasingly complex environment. Business divisions may make unrealistic, competing and unjustifiable demands on the fixed resource available. Within the organization, staff may feel trapped into a slave role with little opportunity to manage workload or to develop new skills.

Charging for IT Services is seen as a method of

- forcing the business divisions to control their own Users' demands

- reducing overall costs and highlighting areas of service provision which are not cost effective

- allowing the organization to match service to justifiable business need, through direct funding.

| Customers will only value what they have to pay for AND 'they will demand value for their money.'

|

Four factors govern the requirements of a Charging system in the organization.

- Level of recovery of expenditure required: If the IT organization opts for full recovery of all costs, then it is opting to function as an autonomous unit, financially self-sufficient. This then requires that costs can be forecast and a Charging system selected that is rational, easily understood and very accurate (although not necessarily based on business unit Charging).

- Desire to influence Customer and User behaviour: Customers and Users are encouraged to make more efficient use of IT resources through levying charges that vary with usage. This can be applied to:

- reducing the inefficient use of IT resources e.g. reprinting large reports

- reducing the peak Capacity required e.g. running lower priority work in periods of lower demand.

There is a conflict between the aim of simple, fixed charges and the levying of variable charges (which makes the Customer's task of Budgeting more difficult). Leading practice would be to help the Customer identify where poor process or lack of knowledge was was increasing the costs of providing their service and work with them to reduce this excess cost to zero over a number of years.

- Ability to recovery according to usage: Recovering costs according to usage requires that the selected Chargeable Items have a reasonable correlation with the amount of resources required to produce them, thereby promoting the perception of a fair pricing and Charging structure.

- Control of the internal market: Introducing market-priced services requires an efficient and effective IT Infrastructure Management with Capacity properly managed, costs well controlled, and services delivered according to expectations. Pitching services at market price in turn leads to being able to provide quality services consistently, and at reasonable prices, thereby establishing a professional interface with Customers. Ideally, the Charging is based on business deliverables, recognizable to the Customers e.g. business transactions, monthly reports.

In order to prevent over-Capacity and under-Charging, or under-Capacity which results in over-budget or insufficient service to meet business needs, the majority of organizations separate the provision of core services from the more optional and variable services, such as installing, moving, adding and changing hardware and software Infrastructure components. This excludes applying 'fixes' to hardware and software, which should be seen as part of the cost of providing the agreed IT Services (defined in the Service Level Agreements).

Additional Capacity is often made available through the use of contractors or third-party service agents. The role of a modern IT organization can often include being an 'honest broker' by assisting the Customers in the selection of the most suitable service provider and reducing costs by 'bulk-buying' on behalf of all Customers.

It is still necessary to fully understand the Cost Model for the in-house IT organization if the core charges are to be fairly assessed and most Customers need to see this broken down by Chargeable Item in order to perform full comparisons with alternative suppliers of service. Any comparison should take into account the different environment and scope of services provided by external suppliers.

![[To top of Page]](../images/up.gif)

Service Catalogues and Service Level Agreements (SLA)

Services are described in a Service Catalogue. The description of a service is incomplete unless accompanied by the costs of that service at one (ie., a basic level) or more (ie., premium variations) of the service. Financial Management ensures the translation of budgets and expenditures from departmental allocations into specific service descriptions maintained in the catalogue. The catalogue describes the organization from the viewpoint of the Customer's main focus - securing and using IT services. Toward this end, Financial Management costs those services, communicates the customer's costs and financial obligations and ensures collection of payments.

The Service Catalogue is a primary addendum or insert in negotiated Service Level Agreements (SLAs). These agreements reflect the results of negotiations over the structure and pricing of services in the Catalogue. SLAs answer the question "What have I promised to do?" The matching cost data answers the other half of the question "How much does it cost to do what I've promised?"

Financial Management is responsible for providing input for the costs of services included in the SLA. In order to recover all operating costs from customer, the IT manager who negotiates an SLA agreement must have a complete understanding of the costs.

This requires cost information from each department and service manager. With this information, the financial manager can assist in determining what it will cost in the future to fulfill the obligations in the SLA.

Accurate cost data provides a solid basis for negotiation. SLAs and historical cost data can provide parties to the negotiation with an accurate picture of what services were provided and at what cost. Without a complete understanding of the costs of providing services, IT managers are unable to negotiate agreements that are fair to each customer and still completely recover the costs of operating the IT environment.

The negotiation process involves not only the negotiation of service levels, but also the setting of prices for the services provided, so that they can be appropriately budgeted for. Part of this activity involves the review of existing SLAs to verify that they are still needed and that the services being provided sufficiently meet customer demands. As part of this evaluation, customers should be prepared to provide input regarding their strategies and goals for the upcoming year. Based on this information, SLAs are revised as needed to more accurately reflect the service requirements of each group. Only then can accurate prices be set for these services.

Negotiating has some pitfalls: the process can be time consuming, and it causes managers to look only at what is best for their particular divisions and neglect what is mutually best for the organization. These two issues must be addressed when preparing to negotiate service prices. It is useful if executive management addresses these issues and provides guidance on the procedures to be used in the negotiation process. Whatever technique is used to set prices and whatever agreements are reached, they must be supported by executive management since they may need to act as the arbitrator if disputes cannot be settled.

![[To top of Page]](../images/up.gif)

Contract Management

IT Financial Management manages several Major and Special Vendor Accounts for the organization. The activities pertain to management of the automation contract after negotiations are complete and the contract is signed, to ensure that all parties uphold the terms and conditions of the contract. Procedures and new processes have been established where needed to enhance the overall effectiveness of the daily operations. Many of the executed contracts are multi-year agreements with enormous dollar commitments to the organization. Major emphasis is placed on proper record keeping, vendor reconciliation and customer chargeback for payments made by the enterprise. IT Financial Management is working closely with IT Acquisitions for the proper ordering of contracted products and services as well as Expense Accounting to ensure proper allocations for chargebacks and payments. IT Financial Management will be the focal point for the organization to these vendors on contract issues, pricing and product information. The Accounts currently managed by IT Financial Management are listed below.

![[To top of Page]](../images/up.gif)

Total Cost of Ownership (TCO)

The total cost of ownership (TCO) is defined as the total cost of an item over its useful lifetime. TCO analysis attempts to include all of the direct and indirect costs. It includes not only the purchase price, but also implementation and training costs, management costs, and support costs. Costs included in TCO fall into the following categories:

- Purchase price

- Training costs

- Application costs

- Support and maintenance costs

- Environmental change costs

- Contracted technical support costs

Purchasing includes the costs incurred in evaluating hardware in the network environment, selecting the unit, costs incurred by the purchasing department, and delivery costs. When viewed from this perspective, it is much more cost effective to purchase equipment from a list of standard configurations.

Every personal computer user requires some form of training at least several times a year. The more change in the IT environment, the more time spent in training. TCO support and maintenance costs include the support function and the service desk. The costs also include the informal system of personal computer experts in the organization. Reducing the number of applications and supported hardware configurations greatly reduces the TCO in the organization.

Based on a review of the studies available, keys to lowering the TCO are to:

- Simplify the acquisition process.

- Develop and maintain standard hardware configurations.

- Select "soft" standards and negotiate enterprise licensing.

- Systematically retire legacy equipment and software.

- Establish a streamlined procurement process and use volume purchasing and site licenses to establish attractive prices on standardized hardware and software. This strategy reduces the complexity of the IT environment. It encourages customers to voluntarily retire their old equipment and to select tested hardware and software, dramatically reducing TCO.

TCO can be divided into two components: direct (real) costs and indirect costs. The direct (real) costs are usually incurred by the IT organization. The user's organization usually incurs the indirect costs.

Shadow support and other indirect costs are, at least in part, a result of the user's perception of service desk shortcomings. Users have been trained not to look to the service desk for support. Some organizations have even taken to calling this discouragement "demand management."

TCO attempts to quantify both direct and indirect costs. More responsive support will reduce shadow support costs. Other method, such as surveys, can be used to measure shadow support.

Organizations attempting to measure and manage TCO run into two problems:

- The intangible costs in TCO are difficult to measure, but, which may comprise the majority of TCO.

- Costs incurred by other organizations are hard for the IT department to control.

- Measurement

IT organizations often find themselves unable to quantify these intangibles without a great deal of effort. However, there are industry studies that have published factors that estimate indirect costs and assist in generating a TCO figure.

The TCO number generated (a benchmark) may be useful in comparing an organization's TCO to an average in a similar environment such as insurance. Regardless of this, it provides a target against which the organization can seek improvement over time.

![[To top of Page]](../images/up.gif)

Financial Manager

- Responsible for the production of cost recovery plans and charging algorithms;

- Leads the development of cost and charging allocation structures for the IT business (across all services)

- Leads the cost projection effort for new services

- Ensures that projected revenues for new services are analyzed and validated

- Analyses and reviews the Financial Management system on a regular basis to ensure its effectiveness and to recommend improvements where needed

- Produces regular reports about the effectiveness of the system for IT Management

- Markets the Financial Management system to the organization, ensures that all users are familiar with procedures and are satisfied with the day-to-day operation of the system;

- Specifies, initiates and maintains the Financial Management system and information structure including cost centers and classifications of workload and equipment requirements

- Supervises the collation of all costs associated with the provision of IT services

- Supervises the monitoring of IT service costs to ensure that business objectives (including the creation of profits from IT service provision, where appropriate) are achieved

- Ensures that total cost of ownership is tracked and reported

- Ensures that financial assets are managed appropriately

- Provides a service budget and design feedback so that appropriate standard service pricing can be established per service level

- Supplies service budgets to provide cost guidelines for internal design specifications

- Provides cost implications of the various scenarios for availability and capacity improvements

- Ensures that cost requirements for availability and capacity designs and plans are incorporated into the service budget

- Assesses the impact of Requests for Change (RFCs) on service cost and attends Change Advisory Board (CAB) meetings, when appropriate

- Provides operational service delivery guidelines related to cost

- Provides cost implications of the various scenarios for capacity improvement

- Provides cost information to cost capacity improvements to the infrastructure so that the ROI can be calculated to justify the IT investment

- Ensures that cost requirements for capacity designs and plans are incorporated into the service budget

- Provides actual customer-specific cost analysis to the Service Level Manager so that customer reports can be developed, and so that service delivery efficiency can be evaluated, and improved, if necessary

- Develops service budget for custom services.

Billing Administrator

- Calculates service invoice and bills customer

- Receive payment and process accordingly

- Ensure that service budget and profit and loss statements are updated with new revenues as they are received.

Financial Management Team

- Collects and organizes service cost and service usage data (e.g., aggregates by customer and by service)

- Compares service cost actuals against cost projections in the service budget, reconciles service budget, and reports variances

- Compares service usage actuals against service usage projections and reports variances

- Prepares IT budget

- Reconciles actual expenditures with IT budget.

Capacity/Availability Teams

- Ensures that various scenarios for capacity and/or availability improvements are provided in Financial Management for comment or review

- Ensures that availability and capacity designs and plans are submitted to Financial Management for review

Service Level Management

- Ensures that services as described in the Service catalog contain up-to-date and accurate financial information describing the service and all variations

- Ensure that Service Level Agreements (SLAs) accurately describe the Customers financial costs and obligations for service provision

Line(s) of Business

- Provide input as to pricing expectations to Financial Manager / Service Provider;

- Participate in Service Value Management exercises;

- Participate with in Customer Management & Service Planning initiatives

- Provide representation on initiatives to forecast future growth and determine service / price expectations and requirements.

![[To top of Page]](../images/up.gif)

Metrics

- Service budgets produced on time, length of time to develop a service budget

- Cost analysis produced at the required time

- Percentage of all costs are accounted for according to the budget plan

- Meeting of monthly, quarterly, and annual financial objectives

- Number (and severity) of changes required to the cost management system

- Average variances in monthly, quarterly, and annual forecasts - original and in-year adjusted

- Number of alterations to the charging algorithm

- Currency and accuracy of Inventories

- Average difference between Standard Costs and actuals (ie. average variance)

- Accuracy of cost recovery reports and expenditure reports

- Customer satisfaction levels with Cost distribution

- Frequency of income/level of profits provisioning to Senior Leadership Team

- Average internal cost to complete a variance report

- Timeliness of annual audits

Measurement Issues

- There are large issues and meriad assumptions involved in allocating costs to particular departments and services. Inevitably, the method selected advantages or disadvantages parts of the organization. IT Financial Management should always states its' methodologies and assumption up front and attempt to mitigate or spread-around any bias' which might be introduced from one year to the next

- It is equally problematic to re-assign costs from a departmental perspective to a service view. The latter view will cross departmental lines and involve participant in a service chain. This service chain will involve the hand-off of one part of the organization to another in order to fulfill the overall service request. The obligations of various participants in this chain are detailed in Service Level Agreements (OLAs) but their ability to perform is affected by the amount of funding directed at their part of the service chain. This introduces additional granularity in the detailing of financial costs should involve IT Financial Management

![[To top of Page]](../images/up.gif)

Financial Management Process Summary

|

| Controls

- IT Management Constraints & Enrichments

- Service Catalogue/SLAs

- Budget Guidelines

- Costing Policies

|

|

Inputs

- Project Charters

- Capacity & Availability Plans

- TCO Studies

- Customer Business Plans

- Service Level Requirements

- CMDB/SPDB

- Existing financial reports and data

- Service Scenarios

| Activities

- Cost Management process planning & improvement activities

- Scenario & service cost planning

- Determine & Revise: mode of costing, cost data sources and reports, IT budget, charging policy, charable items, Sources for resource usage, Pricing methods, Charging calculations, Audit requirements

- Cost System Feasibility test

- Staff awareness & Training

- Cost system implementation

- Monitoring, reporting, biling

- Report Generation

- Post Implementaiton audits

- Billing activities

- Service Performance data

- Analyze service usage and cost

- Calculate service invoice and bill

- Receive payments

- Conduct TCO studies

- Propose Service improvements

|

| Outputs

- Cost Scenarios

- Feasibility Studies

- revised/Verified Service Catalogues and SLAs

- Cost/Charging Policies/Procedures/Models

- Financial Reports

- Budgets

|

|

| Mechanisms

- Depreciation

- Charging

- Financial Analysis

- Financial Measurement & Reporting

- Financial Risk Management

- Continuous Improvement Methdologiis

|

|

![[To top of Page]](../images/up.gif)

Inputs

Project Charters

Charters originate from the Workorder Project Manager as part of Change Management for new or revised Services. These Charters contain information relating to new projects which may require funding during the current or upcoming fiscal year.

Capacity and Availability Plans

Capacity and Availability Management create annual plans that are included in the budgeting process. Accurate cost information is vital in order to accurately budget these upgrades. Planning for availability and capacity management entails the planning for new hardware and software and these costs should be incorporated into the annual budget.

Total Cost of Ownership Studies

There are many studies available that document TCO studies. These studies may provide valuable financial data on the cost of infrastructure components which can be sued as benchmarks or baselines in comparison studies.

Customer Business Plans

Customer annual business plans provide information on strategic intent. These plans form the basis for I&IT planning activities to support and align with this business intent. Financial Management provides advice and assistance in developing cost scenarios, alternatives and feasibility studies associated with these plans.

Service Level Requirements (SLR)

SLRs should be an integral part of the service design criteria, of which the functional specification is a part. They should, from the very outset, form part of the test/trial criteria as the service progresses through the stages of design and development or procurement. A draft SLA should be developed alongside the service itself, and should be signed and formalized before the service is introduced into live use.

Configuration Management Database (CMDB) / Service Performance Database (SPDB)

These data repositories store important information on the state of the infrastructure and, in the case of the SPDB, the financial performance associated with that state. They, like the service catalog and SLAs, provide baseline information to develop scenarios associated with financial constraint or enrichment to services.

Existing financial and accounting reports and data

Existing reports and data will form part of the SPDB. Once reports are produced they should augment the SPDB.

Service Scenarios

Previous service scenarios will also form part of the SPDB and will provide valuable information on developing new scenarios and feasibility assessments.

![[To top of Page]](../images/up.gif)

Controls

IT Management Constraints/Enrichment

Management financial constraints will impose a control or afford opportunity on the exercise of normal financial activities by restricting or enriching resources available.

Service Catalogue - Service Level Agreements

Service Catalog and SLAs contain information related to the current cost of services and the negotiated level of performance associated with them. They provide baseline information to cost service modifications or, in conjunction with performance data, to explain financial variances.

Budget Guidelines

Budget guidelines will control how and where Financial Management can direct its activities.

Costing Policies

Costing policies will affect how expenditures are accounted for and provide incentives or dis-incentives to engage in certain kinds of activities and services.

![[To top of Page]](../images/up.gif)

Mechanisms

Depreciation

Depreciation is the measure of the wearing out, consumption or other reduction in the useful economic life of a fixed asset, whether from use, passage of time, or obsolescence through technological or market changes. Depreciation should be allocated so as to charge a fair proportion of cost or valuation of the asset to each IT Accounting period expected to benefit from its use. The depreciation methods used should be the ones most appropriate having regard to the types of assets and their use in the business.

Charging

The key decisions for Charging are the choice of what to charge for (Chargeable Items) and how much to charge for them. Chargeable Items should be understandable and controllable by the Customer. The more closely the Chargeable Items relate to the organization's business deliverables the better the interface to the Customers.

Where a customer requires charges to be variable, dependent upon usage, the Chargeable Items have to be more specific to that Customer and easily attributable to that Customer. The more freedom the Customer has to define their own service, the more detailed the Charging structure required.

Financial Analysis

Any Changes to IT Capacity (or indeed any other IT or human resources) that were not present in the tactical plans must be reported to Finance Management for inclusion in revised cost plans, projections and so on.

Typically, workload changes as agreed at SLA reviews must also be reported. Cost implications and Charging implications must be explicit in SLAs. SLA changes are normally aligned to annual budget negotiations but IT Services Management may delegate to Service Level Management the powers to vary SLAs within agreed bounds during the year.

If there is a long lead-time between planning and bringing into service (e.g. due to delaying implementation to the start of the financial year) it may become necessary to revise the cost plans, projections and so on. Cost planning should use data that is no more than 3 months old.

Financial Measurement and Reporting

Regular monthly reports for each supported business are required. A monthly summary of costs and revenue should be provided to IT Services Management, together with a balance sheet. Senior IT management committees may also require a report, probably each quarter.

Although the format of management reports is largely dependent on the standards set by the organization it is suggested that reports to Customers are kept simple but include details of:

- how much they have spent on IT during the financial year

- whether the charges made match the predicted profile

- the current Charging policies and IT Accounting methods

- how the IT organization is investing any profits (e.g. in Infrastructure or service improvements)

- any variances, what caused them and what actions are being taken.

Financial Risk Management

Threat-Risk Assessments of the relevant information risks to the achievement of the business objectives form a basis for determining how the risks should be managed to an acceptable level. These should provide for risk assessments at both the global level and system specific levels (for new projects as well as on a recurring basis) and should ensure regular updates of the risk assessment information with results of audits, inspections and identified incidents.

Continuous Improvement

Audits may be performed by internal staff or by external auditors. In both instances audits are intended to confirm that IT Finance Management and the supporting personnel are adhering to defined procedures.

Management should however operate its own controls and not rely solely on audit, whether internal or external. IT Finance Management should therefore perform their own audits and checks to reassure management that the system runs properly and is policed effectively. Independent audit should confirm this and also provide comparison with other organizations.

Outputs

![[To top of Page]](../images/up.gif)

Activities

Cost Management Process Planning and Improvement Process Activities

This sub-process of Cost Management is either triggered by the annual review and improvement of existing IT Service costing and pricing or is invoked as a result of a new Service or IT project. The Financial Manager is accountable and responsible for driving the annual review and improvement cycle. New Service designs and implementations are driven by the Service Manager. IT projects are authorized and managed by Change Management.

- Sub-activities consist of:

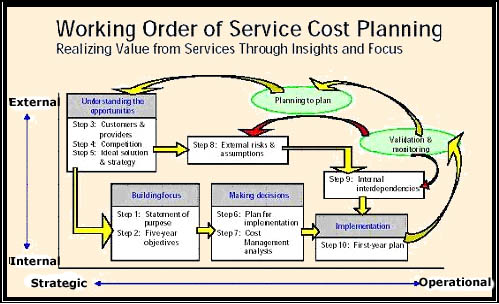

Scenario Planning

Scenario Planning is a strategic planning activity that is especially well suited for analyzing a business environment that is characterized by rapid, turbulent, and discontinuous change. In relation to Financial Management, Scenario Planning is an analysis activity in which assumptions about future states of the world are used to build better IT Service, costing, and charging strategies. It enables the construction of plausible views of the future business environment, to build alternative strategies for each view, and then crates plans to respond appropriately as the future unfolds.

Service Cost Planning

Service Cost Planning provides a context for decision making when evaluating business opportunities relative to IT Services, as well as a framework that can be used to formulate the value proposition of Service relative to Cost of Service. Service Cost Planning formulates how much it will cost to deliver the service to customers (possibly including with differenent service variations), factoring in service delivery assumptions documented in the external design specification and projected availability and capacity cost requirements. For a given service, projected revenues are reviewed per service level in the external design specification. Validation is performed on the feasibility of these projections by factoring in the probability that IT can actually get the projected market share and by comparing the price the customer is willing to pay in the external design specification with projected service costs. The impact of this revenue stream over the life of the service is then determined.

Service Cost Planning provides a context for decision making when evaluating business opportunities relative to IT Services, as well as a framework that can be used to formulate the value proposition of Service relative to Cost of Service. Service Cost Planning formulates how much it will cost to deliver the service to customers (possibly including with differenent service variations), factoring in service delivery assumptions documented in the external design specification and projected availability and capacity cost requirements. For a given service, projected revenues are reviewed per service level in the external design specification. Validation is performed on the feasibility of these projections by factoring in the probability that IT can actually get the projected market share and by comparing the price the customer is willing to pay in the external design specification with projected service costs. The impact of this revenue stream over the life of the service is then determined.

Determine or Revise Mode of Costing

Identify and classify costs (direct or indirect costs, and capital or revenue costs) for budgetary control purposes and for the production of annual Profit and Loss Accounts.

- Capital costs are based on the purchase or enhancement to fixed assets (typically hardware, software, building and plant). They should also encompass the asset's depreciation and interest charges;

- Revenue Costs are the day-to-day expenses incurred in the operation of IT (i.e. staff, maintenance, licensing, electricity, consumables, etc.)

- Indirect Costs are sometimes difficult to allocate to a specific component, department, project, or service. Sometimes decisions need to be made based on the value to the organization. For example, if Application A is an older legacy system and Application B is a newer replacement system; more indirect cost may be allocated to A in order to promote the change of usage to the newer system

- A major purpose of cost classification is to make business decisions about the allocation of costs. Typical allocation considerations are component, process, project, or service usage.

Determine/Revise Cost Data Sources and Reports

Depending upon systems that currently exist, Financial Management may have to draw from numerous sources to derive costing information. The prior establishment of cost data categories can lead to the determination of sources of that information.

Report contents and structures should be in conformance to general accounting practices and should be determined in conjunction with Service Management, Service Level Management, the customers of the Services provided, and as are necessary to meet Financial Management controls and process improvement requirements.

Define/Revise Standard Cost Units

Determine how to allocate expenditures that will occur across customers and services. Cost structures should support the tracking and charging of costs against an overall service by incorporating the sum of staff hours, infrastructure resource consumption, number of seats, service levels, and degree of service customization dedicated to a cost entity, which is the combination of a particular customer and service (and potentially, a business unit within the customer's organization). Cost structures should take into account any economies of scale involved with delivering various combinations of service components or service levels.

Identify chargeable items (called cost units) which are understood by the user and with reasonable correlation to usage of resources (e.g., equipment (servers), software (cost of software, maintenance and support), organization (staff), accommodation (facilities), transfer (reallocated equipment or work performed by a user on behalf of another user)). No matter how the cost units are determined, the aggregated costs need to equal the budgeted plan. Choice of cost units depends very much on the customer familiarity and relationship to IT and the measurability of cost factors.

Once these cost elements are determined, rate calculations are made. Rates per cost unit are determined by dividing the budgeted cost attributable to a cost unit by the forecast level of output by that unit (ie. # lines printed, # of incidents received by the Helpdesk Service, or Mbytes of disc utilized by a specific customer) or the level at normal capacity.

The budgeting process involves development of a standard costing system in which services are costed and charged on the basis of "typical" usage. Standard costs facilitate the measuring of actual performance against plans. Standard unit costing can be recorded as a simple matrix containing the standard rate calculations by service level on one axis and the anticipated service consumption on the other axis. As the financial year proceeds these standard costs are monitored and updated forecasts are made. By comparing standard costs to actual costs, IT is better positioned to focus action to evaluate service value and service portfolio contributions.

Standard Cost units are a gauge of Service Quality. Actual cost less than Standard unit costs may indicate less Service to the customer. Lower than planned unit costs may also indicate greater usage (therefore increased Standard costs) than was originally forecast and budgeted. This too can lead to capacity shortages and customer Service problems.

Determine or Revise IT Budget

Project workload is a pre-requisite for budgeting by obtaining historical data and forecasting workload per cost unit. Workloads should be sub-totalled into three categories: direct work (prime costs - workload specifically associated with end users), indirect work (overheads that support all the work performed on the system), and transfer work (a good or service transferred from one process to another at an agreed cost). Workload estimates, when costed, should equal the IT budget for the year.

Build alternative service budgets from forecasts of incomes and expenditures per service level, using the standard cost. Propose an optimal service budget from alternatives produced. Ensure that it is structured appropriately so that it can be easily reconciled with the profit and loss statement for that specific service.

Determine/Revise Charging Policy

Define charge-back guidelines, price structures, and associated billing rates per customer for generating revenues. To ensure an effective charging structure, determine IT's intent to achieve cost recovery or profits, who pays the bills for IT services, and why and how users will be charged in order to meet management's goals of cost recovery or profit. Four factors govern the requirements of a charging system in the organization:

- Full recovery of all expenditures

- Shaping user behaviour

- Recovery according to usage

- Market-priced services.

Determine/Revise Chargeable Items

The use of a comprehensive CMDB should allow for the `drill-down' from Services to individual hardware components by user. Component usage rates for such things as printing and data storage use can thus be linked to Services provided by user. These components should be defined in terms of their standard cost units. Other Service elements will need to be determined for things such as Incidents handled by user by the Helpdesk Service, Adds/Moves/Changes performed for users, and application usage. Application usage may be allocated to user departments and groups based on their forecasted usage and budget rather than tracked on a `by transaction' basis. IT Projects affect the overall infrastructure and therefore, the impact to all IT Services can be apportioned by Service usage as a percentage of total Services (i.e. a Service Vintage Chart which depicts Service value by age of the Service).

Determine/Revise Sources for Resource Usage

Examine the existing data recording mechanisms for information about planning, reporting, and charging. Information needed includes:

- Workloads;

- Services by customer;

- Costs as determined by the cost allocation structures;

- Resource inventories (hardware and software).

The Configuration Management Database (CMDB) should be capable of providing usage by inventory component as it relates to Service Level Agreements (SLAs) by customers. Additional asset and financial analysis information may be required to determine current asset costs.

Determine/Revise Pricing Method

A Budgeted Standard rate may be the most flexible approach on which to base Service pricing. Based on the annual forecast by customer departments for Services, this rate is fixed for the year based on the formula: Budgeted Cost of the Service divided by the number of hours (availability) or amount of projected usage (transactions to the Service). This allows for project or Service charging based on whatever Charging policy is chosen for cost recovery. This method implies a close monitoring of actual versus forecast usage and annual renegotiations of prices based on refinement of the forecasting procedures. This requires close co-operation with Capacity and Availability Management.

One downside to the above method is that as Service or component usage increases, the rate for that usage decreases. This is especially the case with new equipment, project increases, and Services that have no historical precedent. One way to solve this disparity is to use average capacity or availability (or some negotiated Service target) as the divisor in the equation.

The Prices by Service should be communicated and published periodically.

Define/Revise Charging Calculations

The amount invoiced to the customer by Service is the Standard price for that Service times the usage by period. Usage information can be derived from the CMDB by Service; by customer. Changes to these calculations should be done through Change Management with the assistance of the Service Manager and Service Level Manager. These calculations are typically set during the implementation of a new Service or annually based on the analysis of actual versus forecast costs and revenues.

Determine/Revise Audit Requirements

Audits may be performed by internal or external auditors, based on organizational procedures. Cost Management should perform their own audit procedures to ensure adherence to process and procedures and in order to carry out continuous process improvements. Some things to be checked during an audit:

- Regular and accurate reporting

- Accurate asset and inventory information (CMDB is correct)

- Assets and financial information is correctly accounted and reported

- Examine cost recovery projections and revenue to assess the timeliness and accuracy of the system to match expenditures to revenues

- Check that process and procedure documentation is updated and accurate

- Change and Service Level targets are met.

Cost System Feasibility Test

A pilot of the Financial Management system can be done in a number of ways prior to the implementation. These methods pertain to both the initiation of the system or for each new Service:

- Pilot - A subset of customers, Services, or a specific Service's deliverables can be tested in a prescribed time frame. The Cost Management elements can be analyzed and reworked based on this pilot test

- Notional charging - Customer and IT reporting but no invoice production can be used for some prescribed period in order to capture actual cost and usage information

- Activity Based Costing models - can be developed for the new Service. This presupposes an accurate model of the Service delivery process and a mature Cost Management process based on previous successful Service costing and charging

- Use a third party - to provide industry-based baseline and modelling to predict Service costs. For example, the META group has a service and software for doing Predictive Cost Modelling

Staff Awareness

Educate the customer on the value of services for the cost and on the economies of scale produced be a centralized IT function. Gain the customer's commitment that no "shadow IT functions" exist within a customer's business unit, generating hidden costs in managing IT infrastructure. Institute charging policies that encourage specific user behaviour, like:

- Charging higher prices for older technology and providing discounts on newer, more widely supported technology

- Charging premiums for using services during peak workload windows and discounts for using services during a low-usage time window.

Staff Training

Staff and customer communication and training is a continuous requirement of this, of of many ITIL process. Financial Management continuously reviews and revises processes, procedures, and work instruction documentation, in order to provide Line of business Customers with clear and timely communication on cost and charging issues which impact Service usage. The Financial Manager is responsible for maintaining and implementing an ongoing plan for communication and training.

Cost System Implementation

The Financial Manager is responsible for keeping a step-by-step plan for the implementation and improvement of the Financial Management process. Sometimes this requires the submittal of a Request for Change through Change Management and the creation of a project team and applicable work orders for new systems or tools. For new Service implementation, the Service Manager is responsible for planning and co-ordination with Financial Management.

Monitoring, Reporting & Billing

Delivery costs and service usage data against the service budget (i.e., targeted costs) as well as forecasted service usage are all organized, analyzed, and reported on by service and by customer. Cost performance are reviewed for continuous improvement opportunities.

Worksheets are developed to graphically document the cost elements for rate calculations (cost center forecast), to forecast workload data, or to plot cost recovery break-even point and to compare actual and planned costs.

Report Generation

Reports are distributed monthly to the customer, Service Management, and Service Level Management. These reports track the actual Service usage and cost of Service versus the forecast for Services. The reports to the management of IT summarize the appropriate information and may contain recommendations for improvements in the financial process. Reporting is done on a monthly basis in terms of billing and comparison of forecast to actuals.

Post Implementation Audits

Using activities described above and additional improvement metrics, the Financial Manager is responsible for implementing regular continuous improvement activities to study and prioritize the deficiencies and implement changes to the process.

Monitoring, Reporting and Billing Process Activities

This Financial Management sub-process performs monthly costing and charging functions defined for each Service, application, and project as proscribed by the Planning and Improvement sub-process. The Financial Manager is accountable for every activity of this sub-process.

Service Performance Data (SPDB)

In terms of costing and charging, a performance database consolidates information pertaining to workload (capacity) and Service information. The CMDB, the Capacity Data Base (CDB), the Availability database (ADB) and other sources are queried in order to provide actual Service usage by customer.

Analyze Service Usage and Cost

At regular intervals identified in the Billing Cycle, Service Performance Data, aggregated across all services for a given customer, is analyzed. Analyzed data includes service delivery costs (e.g., labour and expense information recorded by service providers) and service usage information, reflecting service level commitments for that particular customer. Generic service usage for shared costs across customers is also determined through Service Performance Data, and allocations are made against that specific customer. The sum of these two inputs provides the customer's total service cost (Cost Analysis), and is reflected on the Service Invoice for each customer. Cost Analysis is provided to SERVICE LEVEL MANAGEMENT in order to develop customer reports, to IT STRATEGY DEVELOPMENT to reconcile against the overall IT budget, and is stored in the SPDB as a document that can be referenced by all other processes. The service invoice is also stored within the SPDB for historical reference. In response to the Service Invoice, the customer provides Payment to IT.

Calculate Service Invoice and Bill Customer

Customer-specific service usage and generic service (e.g. applications and IT projects) usage allocations are determined and service invoices are generated for specific customers.

Receive Payment

Service payments are collected from customers and service budget revenues updated accordingly. The exact method used is dependent upon agreements reached between IT and its customers, and upon existing accounting procedures and applications.

Calculate Total Cost of Ownership (TCO)

Total Cost of Ownership (TCO) is determined for the costs associated with providing IT Services. This cost includes everything from the floor space in the computer rooms, to electricity costs, maintenance costs, hardware costs, software license costs, IT staff costs etc. In addition, the actual costs within the end user population are included - one typical example is the amount of time which workers spend involved in `peer support'. Peer support is time spent assisting colleagues with issues in using the IT solutions. Peer support, or `FUTZ', is one way in which end user productivity is negatively impacted by poor Service Delivery. Other productivity losses because of poor service availability are also included in TCO.

Total Value of Ownership (TVO) refers to the total value delivered to the business by the IT Services. It includes all benefits arising from the IT Services and the IT Service Management solution which supports them. Some TVO components are the result of reductions in TCO (less failures in the network, brings higher availability of the services and reduces productivity losses in the end user population). Others are generated by direct improvements in the effectiveness of the business such as faster time to market, improved customer satisfaction because of better customer care, etc.

Full strategic partnership between IT and its customers can be reached when value propositions are established between IT Services provided and their enablement of business objectives.

Propose Service Improvements

Service recommendations are proposed from a cost perspective via submittal of a Request for Change based on the cost analysis. Attempts are made to continuously improve the service budget and underlying standard cost structures and allocation rate structures.

![[To top of Page]](../images/up.gif)

Terms

| Term | Definition

|

| Availability | Ability of a component or service to perform its required function at a stated instant or over a stated period of time. It is usually expressed as the availability ratio, i.e. the proportion of time that the service is actually available for use by the Customers within the agreed service hours.

|

| Baseline | The present state of performance, from which changes to services can be reviewed.

|

| Capacity | Everything that is required for delivering the performance agreed on with the client at an optimal service level and cost.

|

| Capacity Design and Workload Forecast | Details of service capacity which aim to balance demand and workload.

|

| Capacity Management | Processes designed to ensure that IT processing and storage capacity match the evolving demands of the business in the most cost-effective and timely manner.

|

| Capacity Plan | The capacity plan documents current levels of resource utilization and service performance. After consideration of business requirements, it forecasts future requirements for resource for IT services that support the business. The capacity plan recommends resource levels required and changes to accomplish operating level objectives in support of the SLA. It includes their cost, benefit, reports of their compliance to IT SLA, their priority and impact to the overall business and the IT infrastructure.

|

| Capital Cost | Costs associated with the purchase or major enhancement of fixed assets-for example, computer equipment (building and plant) -and are often also referred to as "one-off" costs.

|

| Charging | The process for pricing IT services and invoicing for recovery of cost of services.

|

| Client | People and/or groups who are the targets of service. To be distinguished from User - the consumer of the target (the degree to which User and Client are the same represents a measure of correct targeting) and the Customer - who pays for the service.

|

| Configuration Item (CI) | Component of an infrastructure - or an item, such as a Request for Change, associated with an infrastructure - that is (or is to be) under the control of Configuration Management.CIs may vary widely in complexity, size and type, from an entire system (including all hardware, software and documentation) to a single module or a minor hardware component.

|